Main

Index of the Weekly Forecast & Review

Wednesday, April 21, 2010

© Copyright 2010, The Ultrapolis Project – May be used freely with proper

attribution. All other rights reserved.

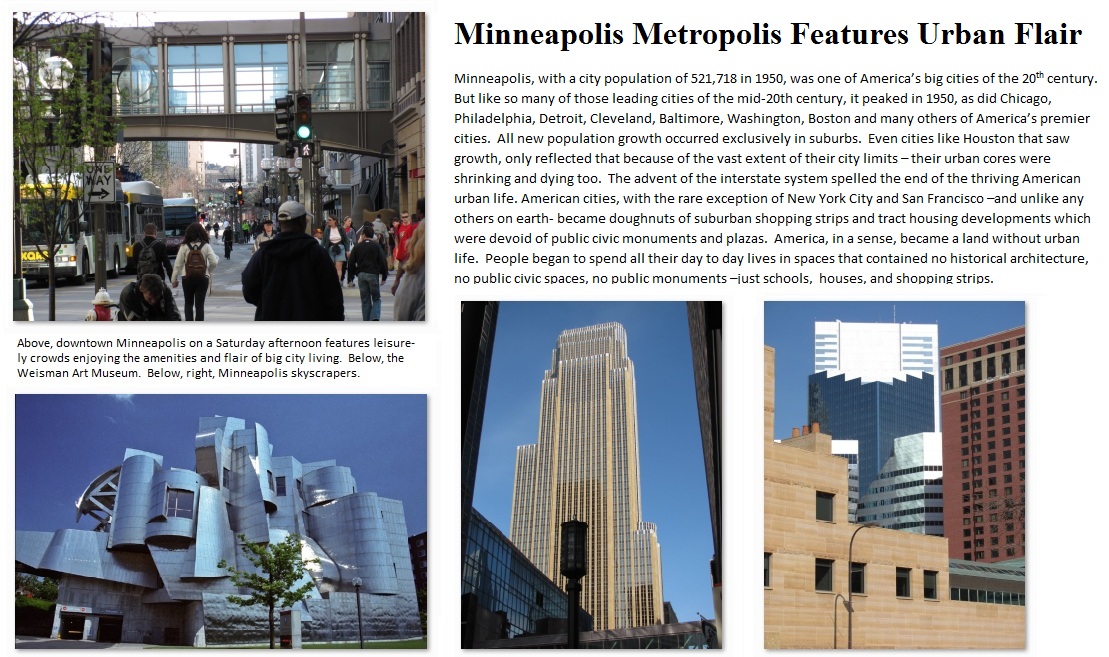

For Minneapolis, like for a few other U.S. cities experiencing a small renaissance, that has begun to change, as more people are beginning to recognize the value of what was lost. In Minneapolis, the population decline bottomed out in the 1990’s, and has since begun to rebound slightly, stabilizing at around 382,000. That number is relatively small by today’s standards, but it’s only across 55 square miles. So, it has a population density twice that of Houston. And it shows. Its skyline rivals that of cities seven times its size like Houston and Dallas, and it has regained something those cities are still struggling to recapture: a thriving city center. A stroll along Minneapolis’ downtown streets on a Saturday afternoon showed leisurely crowds shopping and dining along street-side retail shops, cafes, bars, and restaurants. Beautiful plazas, Movies, live theaters, department stores, sports arenas, high rise residential living, and even the gay district were all within walking distance. And all serviced by light rail and bus services.

Goldman Sachs SEC Suit Maybe Not All It Seems

Dog and Pony Show Meant for Public & Congress, Not the Court

The Securities and Exchange Commission roiled markets worldwide last week

when it announced its lawsuit against Goldman Sachs alleging fraud. The reality is that while Goldman Sachs

obviously engaged in unethical conduct from a purely moral perspective, it is

not clear that they did so from the professional ethical standards of the

investment industry (low standards to be sure), and even less so that they

actually broke any laws. It’s alleged by

the SEC, and is almost certainly true, that Goldman Sachs hid from investors

the fact that the folks that were involved in determining the nature of the

investment vehicles were betting that those vehicles would lose money - pretty

cruddy behavior, no doubt. And, those

investment vehicles did lose money - big.

However, there are two important points to be kept in mind:

1)

These investments were bets, not purchases of a tangible product. That is, they were bets on how selected

mortgage bonds would perform, not purchases of actual bonds. It’s part of what

is called the derivatives market. It is one thing if someone sells you a bond,

having selected it specifically because it would lose money, without telling you

that. It’s another thing when someone

sells you a bet on how that bond will perform, because even though your gain or

loss will mirror ownership gains and losses, there’s an implicit counter-bet. Now, this distinction might be lost on

ordinary individuals. But, here’s the

second point:

2) The investors were major investment banks, not ordinary individuals. The truth is even sophisticated investment people were gripped by the housing bubble mania, and were jumping at any chance presented to get in on the action. Scriptures from many different faiths warn about the effect money has on the human psyche.

Of course, this does not morally justify Goldman’s actions. After all, they didn’t just offer a group of randomly chosen bonds for investors to bet on. They had a favored client, hedge fund manager John Paulson, select which bonds investors would bet on, making sure to select those most likely to lose money (within one year, 99% of the bonds in the deal lost value). It smelled bad enough for investment bank Bear Stearns to turn down involvement in selling the deal on ethical grounds. Credit aside to Bear Stearns, this was mostly a case of amoral and cunning financial sharks eating less cunning ones.

It is very likely that the SEC suit is partially prompted by the recent embarrassments the SEC suffered from its misses with other major financial debacles, like the Bernie Madoff multi-billion dollar Ponzi scheme. But, we think a bigger factor behind this suit is very likely the Obama administration’s push for tighter regulation of derivatives trading, which is currently under consideration in Congress. The goal may not be Goldman at all, and Goldman may very well know it, too.

Gays and Anti-Gay Christians Unite Against College of Law

Supreme Court to Weigh on Question of Diversity Inclusion vs.

Freedom of Assembly

Gays & Lesbians for Individual Liberty (GLIL) filed an amicus brief on behalf of the Christian Legal Society (CLS) in a case before the United States Supreme Court. The case of CLS v. Martinez stems from a policy of the Hastings College of Law of the University of California that requires the CLS to admit non-Christians and gays to its membership, if it wishes to be an official student group. According to Dean Leo Martinez, no group can restrict its membership on any basis. Jewish groups must allow Nazi-sympathizers, black student groups cannot exclude Klu Klux Klan members, etc. According to GLIL, “under Hastings’ forced membership policy, only majority viewpoints (or those viewpoints too banal to interest the majority) are actually assured a voice in Hastings’ forum.” The group explains that “It should come as no surprise that GLIL does not agree with CLS’s views regarding homosexuality. But the constitutional remedy for speech with which one disagrees is ‘more speech, not enforced silence.’” It’s refreshing, for a change, to hear a gay rights group express a coherent and principled stand on a constitutional right, instead of simply and blindly support whatever promotes acceptance and approval of gay, lesbian, bisexual, transgender rights in the short term.

Ultrapolis Weekly Readers Favor Cable and NPR for News

Network Evening Broadcasts News Source for only a Quarter of

Respondents

During the month of March we took our first survey of our

readership’s social, cultural and political profile. The survey is not scientific, since only

self-reported responses were included.

We have closed that survey, and now, during the next few weeks, we will

be sharing with you the results of that survey.

This is the second installment on that series of briefs.

In Question 6, we asked our readers to identify their all

their sources of hard news. Respondents

were able to select more than one choice.

Topping the list was cable news as a group, with 70% identifying it as a

source; close behind was NPR by itself garnering 67%. Major online news websites came in third at

59%. National radio talk shows followed

at 34%, with major newspapers right behind at 33%. Local news and Network tied at 25%, followed

closely by commentary shows like O’Reilly and McLaughlin at 23%. We were happy to learn that comedy

infotainment shows and blogs were near the bottom, with only single digit

numbers. Of the broadcast evening news

and cable news, cable easily won; CNN got 40%, Fox News 31%, and MSNBC got

9%. That CNN beat out Fox News among our

respondents is ironic given that among the general population, Fox News beats

CNN 2.5 to 1 throughout the day, and 3.6 to 1 at prime time; and especially

given that, as we reported last week, our readership tilts slightly to the

right.

![]()